SEC Approves NASDAQ Board Diversity Rule

Download a pdf of this article »

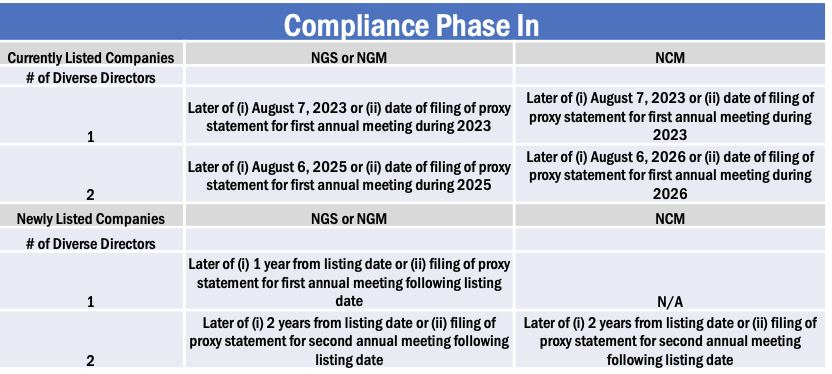

On August 6, 2021, the SEC approved new rules for the Nasdaq Stock Market (“Nasdaq”) that address diversity requirements for the board of directors of listed companies. Generally, the new rules would establish “aspirational” board diversity objectives for Nasdaq-listed companies of at least two “diverse” directors, including one female director and one director from an underrepresented community (the “Board Representation Rule”). Companies that do not choose to meet such objectives would be required to provide an explanation regarding why they do not meet the diversity objectives. Companies listed on the Nasdaq Global Select Market (the “NGS”) or the Nasdaq Global Market (the “NGM”) would have until August 7, 2023 (two years from when the new rules were approved) to have at least one female or diverse director (or explain why they don’t meet this objective) and until August 6, 2025 (four years from when the new rules were approved) to have both a female and a diverse director (or provide the required explanation). Companies listed on the Nasdaq Capital Market (the “NMS”) would have until August 7, 2023 to have at least one female or diverse director (or explain why they don’t meet this objective) and until August 6, 2026 to have both a female and a diverse director (or provide the required explanation).

In addition, the new rules would establish a prescribed tabular format pursuant to which Nasdaq-listed companies would be required to disclose board-level diversity data on an annual basis using a standardized board diversity matrix (the “Diversity Data Rule”). This disclosure requirement goes into effect in 2022.

At the same time, the SEC approved a new rule providing Nasdaq-listed companies which, by definition, do not have the specified number of diverse directors with access to various board recruiting services, which would provide access to a network of board-ready diverse candidates for these companies to identify and evaluate.

Even though the Board Representation Rule has a deferred effective date and transition periods, it’s not clear whether it will have much impact on technology and life sciences companies, especially those headquartered in a state such as California that has already adopted laws requiring companies to have diverse members on their boards. Many of these companies have already satisfied the gender diversity requirement and are in the process of changing the composition of their boards to meet the broader diversity requirement. For these companies, the most likely impact of the new rules will be the inclusion of the standardized diversity matrix disclosure in proxy statements as required by the Diversity Data Rule.

This Thoughtful Pay Alert describes the new rules and when they go into effect.

Background

For several years, investor groups, institutional shareholders, the major proxy advisory firms, and some states have adopted policies or laws putting pressure on corporate boards to diversify board membership. As a result, it has become a prominent corporate governance issue.

While SEC rules have long required that companies disclose whether, and how, their boards consider diversity in nominating new directors, they largely leave to companies to decide how they define diversity and take it into consideration in the nomination process. In 2019, the SEC Staff began to offer interpretive guidance suggesting that, to the extent a board has considered an individual’s self-identified diversity characteristics (such as race, gender, ethnicity, religion, nationality, disability, sexual orientation, or cultural background), the company’s discussion of the director’s qualifications should include identifying those characteristics and how they were considered (with the individual’s consent).

In a major development in December 2020, Nasdaq became the first national securities exchange to submit proposals to the SEC that would amend its listing standards regarding board diversity and related disclosure. In February 2021, following extensive discussions with the SEC Staff and review of more than 200 comments on the proposals, Nasdaq amended the proposals to, among other things, make them more flexible and add grace periods for companies to regain compliance if they fell out of compliance with one or more of the standards. After promising additional time for the public to comment on the amended proposals, the SEC agreed to take them up in August.

Board Representation Rule

Generally, the Board Representation Rule requires each company listed on the NGS, the NGM, and the NMS (with certain exceptions) to have, or explain why it does not have, at least two members of its board of directors who are “diverse,” including:

- At least one diverse director who self-identifies as female; and

- At least one diverse director who self-identifies as an underrepresented minority or as LGBTQ+.

Definition of “Underrepresented Minority”

For purposes of the Board Representation Rule, the term “underrepresented minority” means, in the case of a U.S. company, someone who self-identifies as African American or Black, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more races or ethnicities. Foreign issuers may satisfy the diversity objective for their second director if the person is an underrepresented individual in their home country jurisdiction. Helpfully, the Board Representation Rule specifically defines what is meant by each “underrepresented minority” category, as well as the term “LGBTQ+.”

Compliance Timing

The Nasdaq has provided for a gradual phase-in of the Board Representation Rule for currently-listed companies over a multi-year period based on a company’s listing tier. The new rules take a similar approach to phasing in compliance for newly-listed companies depending on their listing tier.

Companies listing before the end of the transition period will generally have the longer of the remaining length of such transition period or two years to comply. This “phase-in” period for newly listed companies will apply to companies listing in connection with an IPO, a direct listing, a transfer from another exchange or over-the-counter market, a spin-off or carve-out from a company listed on Nasdaq or another exchange, or through a merger with a SPAC.

Disclosure of Non-Compliance

Where a company elects to satisfy the requirements of the Board Representation Rule by disclosing why it does not meet the applicable diversity objectives, it must specify the applicable requirements of the rule it does not satisfy and explain the reasons why it does not have the requisite number of diverse directors. Nasdaq has indicated that it does not plan to evaluate the substance or merits of a company’s explanation.

If a company is required to explain why it is not in compliance with the Board Representation Rule, the disclosure must be provided in advance of the company’s next annual meeting of shareholders. Such disclosure is to be provided in the company’s proxy statement (or in its annual report on Form 10-K if it does not file a proxy statement) or on the company’s website.

Grace Period and Penalty for Non-Compliance

If a company fails to comply with the Board Representation Rule (that is, either comply or explain), it would have until its next annual meeting of shareholders or 180 days from the event that caused the deficiency to cure the deficiency. A company that did not regain compliance within the applicable cure period would be subject to delisting.

Exceptions to General Rule

Smaller reporting companies and foreign issuers (including foreign private issuers) can satisfy the Board Representation Rule by having two female directors. Alternatively, a smaller reporting company may satisfy the rule with one female director and one director who is a member of an underrepresented minority or LGBTQ+. Similarly, a foreign issuer may satisfy the rule by having one female director and one director who self-identifies as LGBTQ+ or as an underrepresented individual in the company’s home country jurisdiction.

Currently-listed companies with boards of five or fewer members, regardless of listing tier, are required to have, or explain why they do not have, one diverse director (who may self-identify as female, an underrepresented minority or LBGTQ+) by August 7, 2023. Similarly, newly-listed companies with boards of five or fewer members, regardless of listing tier, are required to have, or explain why they do not have, at least one diverse director by the later of (i) two years from their listing date or (ii) filing of the proxy statement for the second annual meeting following their listing date. Such companies are not required to have at least two diverse directors (or provide the required explanation).

Diversity Data Rule

Generally, the Diversity Data Rule requires each Nasdaq-listed company to annually disclose its board-level diversity data in substantially the same format (the “Board Diversity Matrix”). In this matrix, a company would be required to provide the total number of directors on its board and the company (other than a “foreign issuer”) would be required to disclose:

- The number of directors based on gender identity (female, male, or non-binary) and the number of directors who did not disclose gender;

- The number of directors based on race and ethnicity (African American or Black, Alaskan Native or Native American, Asian, Hispanic or Latinx, Native Hawaiian or Pacific Islander, White, or two or more races or ethnicities) disaggregated by gender identity (or did not disclose gender);

- The number of directors who self-identify as LGBTQ+; and

- The number of directors who did not disclose a demographic background under either of these latter two categories.

Separate rules apply to a company that qualifies as a “foreign issuer” (including a foreign private issuer).

Location of Disclosure

Nasdaq-listed companies would be required to provide the Board Diversity Matrix in the company’s proxy statement (or in its annual report on Form 10-K if it does not file a proxy statement) or on the company’s website. Following the initial year of compliance, companies would be required to disclose the current year and immediately prior year’s diversity statistics using the Board Diversity Matrix.

Compliance Timing

A currently-listed company must provide its initial Board Diversity Matrix in 2022 based on the following:

- If a company files its 2022 proxy statement before August 8, 2022 and does not include the Board Diversity Matrix, then it has until August 8, 2022 to provide the matrix.

- If a company files its 2022 proxy statement on or after August 8, 2022, then it must either include the Board Diversity Matrix in its proxy statement or post the matrix on its website within one business day of filing its proxy statement.

- If a company does not intend to file a 2022 proxy statement, then it has until August 8, 2022 to provide the Board Diversity Matrix on its website.

Newly-listed companies have one year from the date of their listing on Nasdaq to provide their initial Board Diversity Matrix.

Grace Period and Penalty for Non-Compliance

If a company fails to provide the required matrix, it would have 45 days calendar days to submit a plan to regain compliance and, upon review of such plan, up to 180 days to regain compliance. A company that did not submit a plan or regain timely compliance would be subject to delisting.

Board Recruiting Service Rule

On August 6, 2021, the SEC also approved a new rule providing Nasdaq-listed companies which, by definition, do not have the specified number of diverse directors with one year of complimentary access for two users to the board recruiting services of a variety of third-party service providers, which would provide access to a network of board-ready diverse candidates for these companies to identify and evaluate, to help advance diversity on their boards. To facilitate this effort, Nasdaq has established partnerships with Equilar, Athena Alliance, and theBoardlist offering free access for a limited time to their board-search platforms to Nasdaq companies.

Observations

The SEC’s approval of the Nasdaq diversity rules is consistent with its own initiatives to expand disclosure requirements about environment, social, and governance (“ESG”) matters. Just recently, as part of its annual regulatory agenda, the SEC indicated that it was working on rules involving corporate board diversity disclosure, so it will be interesting to see how the Nasdaq rules influence the SEC’s approach to this subject. It remains to be seen whether The New York Stock Exchange or any other exchange follows the Nasdaq’s lead.

These actions addressing the composition of corporate boards continue to be controversial. The SEC approved the Nasdaq rules by only a 3-2 vote, reflecting the concern of some Commissioners that the rules are beyond the scope of what a national securities exchange is permitted to regulate under the Securities Exchange Act of 1934. At the same time, some of the private sector organizations that have instituted legal challenges to the state laws imposing board gender diversity requirements, have indicated that they intend to challenge the Nasdaq diversity rules on various grounds, including violations of the U.S. Constitution and the Civil Rights Act of 1964. Thus, approval of these rules provides no assurance that they will ultimately become effective or remain in their current form.

Further Information

The SEC’s order approving the Nasdaq rule changes can be found here. In addition, Nasdaq has posted (and has been regularly updating) a list of Frequently-Asked Questions (“FAQs”) which can be found here.

Need Assistance?

Compensia has significant experience in helping companies understand and address Nasdaq’s corporate governance listing standards. If you have any questions on the topics covered in this Thoughtful Pay Alert or would like assistance in assessing how the policies are likely to affect your board, please feel free to contact Mark A. Borges or Jason Borrevik. Mark can be reached at 415.462.2995 or mborges@compensia.com and Jason can be reached at 408.876.4035 or jborrevik@compensia.com