Technology Company Responses to an Unfavorable Say-on-Pay Vote

Download a pdf of this article »

The 2020 proxy season marked the 10th anniversary of the implementation of the shareholder advisory vote on named executive officer compensation (the “Say-on-Pay” vote) required by the Dodd-Frank Wall Street Reform and Consumer Protection Act. We have seen the development of a new era of shareholder engagement on executive compensation matters. Many companies now routinely communicate with their major shareholders on their executive and equity compensation philosophies and program terms (including pay levels and structures) through direct discussions and enhanced disclosure. As a result, a significant majority of companies routinely register 90%+ support for their Say-on-Pay vote.

Even so, each year a sizable number of companies experience difficulties with their Say-on-Pay vote, a few on a recurring basis but most for just a year or two, when there is a perception of a “pay-for-performance” disconnect or significant problematic pay practices. Two percent to 3% of Russell 3000 companies fail Say-on-Pay each year and another 4% to 6% register what the major proxy advisory firms characterize as “significant opposition” to their pay program (less than 70% support with ISS and less than 80% support with Glass Lewis) Moreover, it is not necessarily the same companies encountering difficulties each year. Approximately 10% of the companies in the Russell 3000 and 8% of the companies in the S&P 500 have failed Say-on-Pay at least once over the past decade.

Impact on Technology Companies

From our experience advising a broad range of technology companies during the Say-on-Pay era, we know that these companies are not immune from these trends. Each year, a number of technology companies either fail their Say-on-Pay vote or record significant opposition to the proposal. Sometimes companies may anticipate that a difficult Say-on-Pay vote is coming, so the resulting vote is not a surprise. Other times, the outcome is more unexpected. Thus, it is crucial to know how to respond when a company fails Say-on-Pay or receives an early warning sign from shareholders about its Say-on-Pay proposal.

Compensia recently conducted a study going back to 2014 of responses to Say-on-Pay votes of technology companies that failed their Say-on-Pay vote or received less than 70% shareholder support. Specifically, we looked at the actions taken by 25 companies that failed Say-on-Pay or received significant opposition to their Say-on-Pay proposal during the one-year to two-year periods following the unfavorable vote (including changes in their disclosure).

We found that the most common actions taken by a technology company following a failed vote or low support were as follows:

Additional observed actions included the implementation of compensation risk mitigators such as the adoption of a compensation recovery (“clawback”) policy (36%) or the adoption of stock ownership guidelines (24%) and the elimination of perceived poor pay practices such as the removal of “single-trigger” vesting acceleration rights upon a change in control (12%). In previous years, we also observed the removal of many Section 280G excise tax “gross- up” rights. However, at this point such provisions have largely been phased out of the market.

While the foregoing actions represent the most common responses that we have seen from technology companies seeking to get back on track following a failed Say-on-Pay vote or low vote support, other observed outcomes can be more dramatic. For example, we noted that 52% of the observed companies made a change to the membership of their Compensation Committee in the two years following an unfavorable result, while 36% of the companies subsequently changed their independent compensation consultant. Although the reasons for such changes usually cannot be directly attributed to the Say-on-Pay vote, it is possible that, in the course of their review, the Board of Directors determined that a fresh point of view might benefit the oversight of the executive compensation program.

Although the size of the CEO’s pay package is generally a key factor in the analysis of the Say-on-Pay proposal, our research was inconclusive as to whether a failed vote or low support ultimately resulted in a reduction in CEO pay in a subsequent year. While our data suggested that some companies lowered their CEO compensation when making their compensation decisions the following year, this practice did not appear to be universal. Nonetheless, in evaluating a failed vote or low support, companies should consider the absolute level of CEO pay as a potential issue and whether a reduction is appropriate in light of shareholder concerns.

Specific Responses

Changes to Long-Term Incentive Compensation Program

As noted above, the most common response to a failed vote or low support was the re-evaluation of the composition of the long-term incentive compensation program. As reflected in the following chart, most often, this involved a change in the mix of equity vehicles used to compensate executives. Both ISS and Glass Lewis favor that a majority of the equity awards granted to executives be performance-based. Consequently, it is not surprising that 74% of the companies making changes to their LTI programs changed the pay mix, with 65% of the companies changing their overall mix doing so by introducing performance stock unit (“PSU”) awards (typically, to approximately 50% of the total LTI award value). Our research further indicated that the average weighting of performance-based equity awards for CEOs increased from 17% to 60% at companies changing their equity award mix.

The second most common LTI change (48%) was to introduce performance-based equity awards into the LTI program where previously awards had been entirely time-based. Typically, these awards were granted in the form of PSUs. For companies that introduced performance-based equity for the first time, the average weighting of the new vehicle was approximately 60% of the total LTI award value.

For companies considering the introduction of stock options, it’s worth a reminder that the major proxy advisory firms and certain key institutional shareholders do not consider time-based stock options to be performance-based equity awards.

The third most common LTI change (13%) was to change the vesting schedule and/or performance period for LTI awards, typically extending them to three or four years.

We also noted that 13% of the companies that made changes to their LTI compensation programs decided not to grant any equity award to the CEO in the year following the failed vote or low support.

Changes to PSU Program

Where a company already uses PSUs in its long-term incentive compensation program, another common change is to re-evaluate and often modify the design of the awards.

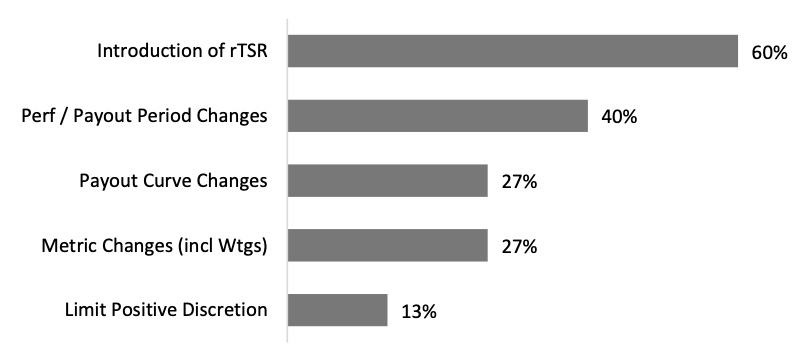

We found that the most common change to a PSU program is to introduce relative total shareholder return, either as a metric or a modifier (60%). The next most popular change is to extend the award performance/payout period (40%) from a single year to a multi-year arrangement (either two or three years) to better align the pay and performance outcomes to longer-term shareholder interests.

Other common changes to PSU awards may involve modifying the payout curve (27%), changing the performance metrics (27%), and limiting the ability of the Compensation Committee to exercise positive discretion in determining fiscal award payouts (13%). When it comes to changing the performance metrics, the change is often made to avoid the use of the same metrics in both the short-term and long-term incentive plans, a practice which the proxy advisory firms do not favor.

Changes to Short-Term Incentive Compensation Program

Consistent with the focus on long-term incentives, often companies will re-evaluate their short-term incentive compensation plans in light of their Say-on-Pay vote and the feedback that they receive from shareholders. Most often, this will involve an examination of the plan metrics as part of a coordinated effort to eliminate any overlapping metrics with the company’s long-term performance-based awards. It can also involve a rebalancing of the metrics used in the plan to place greater emphasis on corporate performance (using financial, operational or strategic metrics) and a reduction in the portion of the award which is based on discretionary objectives (including ones that aren’t disclosed even in the following year’s CD&A) or individual performance, which is often subject only to a qualitative review by one or more senior executives or the Compensation Committee. Finally, the company may opt to reduce or eliminate the level of discretion that may be exercised by the Compensation Committee in determining final award payments.

Meaningful Shareholder Engagement and Enhanced Disclosure

A primary objective underlying the Say-on-Pay vote requirement has been to stimulate a dialogue between companies and shareholders on executive compensation matters. Where there is significant opposition to an executive compensation program, there is a general expectation that the company will take steps to understand (and potentially respond to) the reasons why so many shareholders are critical of the program. In some instances, shareholder opposition may be linked to poor stock price or financial performance. In other cases, the vote may be driven mainly by an unfavorable ISS or Glass Lewis vote recommendation versus shareholder-specific concerns. Thus, in the case of a failed vote or low support most companies will conduct an organized outreach effort with their key shareholders to understand the reasons for the negative vote and/or to learn of any other concerns about the executive compensation program. As a practical matter, this has become almost obligatory as both ISS and Glass Lewis expect some level of shareholder outreach following a failed vote or low support, supplemented with extensive disclosure of these activities in the following year’s CD&A. Typically, this includes a summary of the feedback received from shareholders (often quantifying the number of investors spoken to and their aggregate percentage of ownership) and the company’s response to that information. Failure to provide this type of disclosure may lead to an “against” recommendation for directors up for re-election in the following year.

In our experience, often one of the principal criticisms of the executive compensation program is a lack of transparency or clarity about one or more aspects of the pay program, typically either (or both) the short-term and long-term incentive compensation plans. In response, most companies will enhance this disclosure, including making greater use of tables and graphics to explain the design of the plan and describe how award amounts were determined. Often, these companies will add or enhance their realized or realizable pay disclosure to illustrate the pay-for-performance alignment with their financial results.

Final Observations

We also note that, from our observations, shareholders tend to treat the Say-on-Pay proposal and equity plan proposals that are up for a vote at the same Annual Meeting as independent matters. We did not note a material correlation between a failed vote or low support for Say-on-Pay and low support for an equity plan proposal.

Of course, each company’s circumstances are highly situational and will require a detailed evaluation of the reasons for the failed vote or low support. This will be critical to the development of an effective response strategy addressing the company’s specific issue or issues. As an experienced advisor to technology companies and the specific characteristics of their executive compensation programs, we are well positioned to provide assistance to companies looking to rectify their current standing with their shareholders and get their pay program back on track.

Need Assistance?

Compensia has significant experience in helping companies understand and address a failed Say-on-Pay vote or significant opposition to a Say-on-Pay proposal. If you have any questions on the topics covered in this Thoughtful Pay Alert or would like assistance in formulating an effective shareholder engagement program, please feel free to contact Jason Borrevik at 408.876.4035 or Mark A. Borges at 415.462.2995.