Employee Stock Plan Proposals at the Bay Area Tech 120

It was another active year for employee stock plan proposals among the 120 largest publicly-traded technology companies primarily headquartered in the San Francisco Bay Area (“the Bay Area Tech 120”).

As in prior years, we have compiled the voting results and related information from the 2015 proxy season of proposals to either adopt a new employee stock plan or increase the share reserve for an existing plan. This year was notable as, beginning in February 2015, Institutional Shareholder Services (“ISS”) began applying its new “equity plan scorecard” to evaluate employee stock plan proposals.

This Thoughtful Pay Alert summarizes the results of our review, based on the information disclosed in the companies’ proxy statement filings with the SEC.

Number of Employee Stock Plan Proposals Remained Constant in 2015

Just over one-quarter of the Bay Area Tech 120 (31 companies) submitted proposals to their shareholders since our last review (based on a review of proxy statements filed for companies with fiscal year ends during the period from June 1, 2014 through May 31, 2015). This number was consistent with 2014, but slightly lower than in prior years due to the ongoing inclusion of more newly-public companies with “evergreen” provisions in their employee stock plans. Specifically, 30% (36) of the companies in the Bay Area Tech 120 have an active “evergreen” feature in their plan which provides for the annual replenishment of shares to the plan share reserve without shareholder approval for up to 10 years following an IPO.

This pattern reflects the typical life cycle for many employee stock plans where mature public companies generally seek to replenish their employee stock plan share reserve, or adopt a new plan, approximately every two to three years. This pattern also reflects, in part, the dilution policies of the major proxy advisory firms, such as ISS, and certain institutional investors, which typically limit the number of shares that they will approve for issuance at any given time for purposes of making equity awards.

As noted above, ISS made significant changes to its equity plan voting guidelines in advance of the 2015 proxy season. ISS now includes a review of certain stock plan terms and conditions, as well as a company’s equity award grant practices, as part of its more “holistic” analysis of equity compensation plan proposals. This review includes the presence (or absence) of specific plan features, such as whether the plan (i) prohibits discretionary vesting acceleration, (ii) requires minimum award vesting, or (iii) prohibits the company from recycling certain plan shares for re-grant, and grant practices, such as whether the company maintains an equity award “clawback” provision or a stock retention policy for its executives. In our review of this year’s stock plan proposals for the Bay Area Tech 120, we did not find many companies that significantly revised their stock plan terms and/or practices in response to the changes to the ISS voting guidelines. Perhaps more importantly, we also did not see a change in the related voting outcomes for this review cycle (see below).

We also note that 16% of the Bay Area Tech 120 (19 companies) submitted employee stock purchase plan proposals to their shareholders during the past 12 months (compared to 21 companies during the 2014 review period).

All Proposals Approved in 2015

As has been the case from 2012 through 2014, each of the companies that submitted an employee stock plan proposal to its shareholders during the past 12 months saw that proposal approved. The average level of support was 84% of the votes cast, and 64% of the shares outstanding.

Size of Share Reserve Requests in 2015

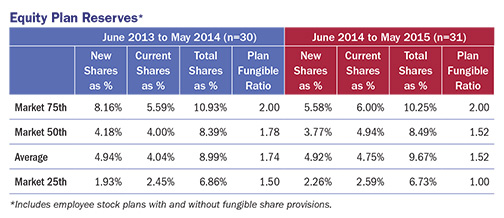

Among the 31 companies that sought shareholder approval of a new or amended employee stock plan during the past 12 months, the share requests (as a percentage of the company’s outstanding shares) ranged as follows:

As evident from the foregoing table, the size of share requests was lower than in the previous 12 month cycle (especially at the 75th percentile) while the overall post-request share reserve size remained flat.

High (but Declining) Prevalence of Fungible Share Provisions

In 2015, the majority (65%) of the Bay Area Tech 120 employee stock plan proposals included a “fungible share” provision, limiting the amount of “full-value” equity awards (such as restricted stock unit and performance share awards) that may be granted from the share reserve. The prevalence of fungible share provisions declined noticeably from the prior 12 month period (83%), however, likely due to a continued shift from stock options to full-value awards at the Bay Area Tech 120 companies.

Fungible share ratios ranged between 1.36:1 to 2.25:1 (with a median ratio of 1.76:1) and, in most cases, were specifically derived for each company from the relative fair value of a full-value award compared to the fair value of an appreciation-based award (based, in many cases, on ISS’ methodology for calculating “fair value”).

Need Assistance?

Compensia has extensive experience in assisting companies in formulating employee stock plan proposals and developing effective strategies for obtaining shareholder approval of such proposals. If you would like assistance in analyzing your equity compensation strategy or negotiating the various pressure points in implementing an employee stock plan or a share reserve increase, or if you have any questions on the subjects addressed in this Thoughtful Pay Alert, please feel free to contact Jason Borrevik at 408.876.4035 or Mark A. Borges at 415.462.2995.

Download a pdf of this article »